Hey y'all, today we're gonna dive into a topic that is crucial for everyone, regardless of their background or skin color. We're talking about managing our finances, whether it's for our businesses or our personal lives. So grab a seat, get comfortable, and let's get started!

How to Manage Business Finances? [7 Key Tips]

Running a business is no easy feat, and managing the finances can sometimes feel like a whole other beast. But worry not, fam, we've got you covered with these 7 key tips:

- Budget like a boss: Create a financial plan that outlines your income, expenses, and savings goals. This helps you stay organized and make informed decisions.

- Track every dime: Keep a record of all your business expenses and track them regularly. It's all about staying on top of your cash flow and identifying areas where you can save.

- Separate business and personal: Set up separate bank accounts and credit cards for your business. This not only simplifies your bookkeeping, but it also protects your personal finances.

- Build an emergency fund: Life is full of surprises, and having a financial buffer for your business can be a game-changer during difficult times.

- Stay on top of taxes: Understand your tax obligations as a business owner. Hire a tax professional if needed to ensure compliance and avoid any headaches down the line.

- Invest in your business: Allocate funds for growth opportunities, marketing strategies, and professional development. Investing wisely can propel your business forward.

- Seek professional advice: Don't be afraid to reach out to financial advisors or business consultants who can provide valuable insights and guidance tailored to your specific needs.

Managing Personal Finances Right - Sunny Leand

Now, let's shift gears a bit and talk about managing our personal finances. It's essential to take control of our own money, so here are a few tips to help you on your financial journey:

- Create a budget that works for you: Determine your income, fixed expenses, and prioritize your savings. Remember to set aside some money for fun too!

- Track your spending: Keep a close eye on your expenses and identify any areas where you can cut back. Small changes can add up and make a significant difference in the long run.

- Pay off high-interest debts: If you have credit card debt or loans with high-interest rates, make it a priority to pay them off. This will save you money in interest payments over time.

- Start an emergency fund: Life is unpredictable, and having an emergency fund can provide a safety net in times of financial stress. Aim to save at least three to six months' worth of expenses.

- Invest for your future: Consider investing in retirement accounts or other investment vehicles to grow your wealth over time. Start early and take advantage of compound interest.

- Protect yourself and your assets: Ensure you have appropriate insurance coverage, such as health insurance, auto insurance, and homeowner's insurance. This safeguards you from unexpected expenses.

- Continuously educate yourself: Financial literacy is key to making informed decisions. Read books, follow personal finance blogs, and stay up to date with relevant financial news.

Remember, fam, managing our finances is an ongoing process. Taking small steps towards financial stability and growth can have a significant impact in the long run. So let's commit to being accountable, staying informed, and building a bright financial future for ourselves and our communities. Together, we can thrive!

If you are looking for Pin on Entrepreneurs you've visit to the right page. We have 15 Pictures about Pin on Entrepreneurs like How Can You Stay on Top of Your Business's Finances? | CFO Source, Advice for Managing Your Business' Finances - NorthPoint Executive Suites and also Smart Tips for Managing Your Finance as an Entrepreneur. Here you go:

Pin On Entrepreneurs

www.pinterest.com

www.pinterest.com money management tips infographic startup manage success lifehack expenses artikel van learn

How To Manage Business Finances? [7 Key Tips]

![How to Manage Business Finances? [7 Key Tips]](https://www.invoiceowl.com/wp-content/uploads/2021/06/most-valuable-tips-to-manage-your-business-finances.jpg) www.invoiceowl.com

www.invoiceowl.com finances finance accounts separate

Advice For Managing Your Business' Finances - NorthPoint Executive Suites

www.northpointexecutivesuites.com

www.northpointexecutivesuites.com finances managing business credit shareholders rights marketing score ignore metrics vanity stats count reports track suites executive northpoint advice growth

5 Effective Tips For Managing Personal Finances - Finance Terms

www.financeterms.org

www.financeterms.org First Step To Managing Your Finances | The Star

www.thestar.com.my

www.thestar.com.my finances managing financial

Smart Tips For Managing Your Finance As An Entrepreneur

catalystforbusiness.com

catalystforbusiness.com managing finances tips finance entrepreneur smart business

Manage Your Personal Finance In 9 Practical Ways

financialwellness.org

financialwellness.org manage finances

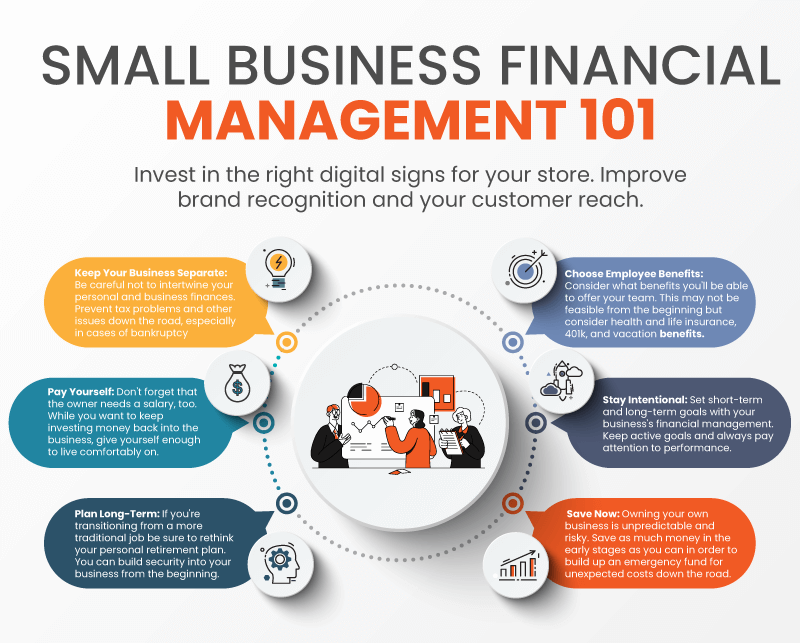

Tips On Managing Small Business Finances [Infographic] | Business

![Tips on Managing Small Business Finances [Infographic] | Business](https://i.pinimg.com/originals/f5/79/89/f57989067e8e1dbe5fe56cc63c14c82a.jpg) www.pinterest.com

www.pinterest.com finances

Managing Personal Finances Right - Sunny Leand

sunnyleand.com

sunnyleand.com finances managing manage mengatur keuangan literacy budgets disclosure gcr presidencial discurso pintek overcome hardships abraham tomada posse pribadi nih basics

4 Things To Do To Improve Your Finances - Acquisition International

www.acquisition-international.com

www.acquisition-international.com finances accountants thrive tax acquisition international finance managing paying

Practical Tips For Managing Finances During A Crisis Or Difficult Time

ceoof.me

ceoof.me finances managing crisis

How To Manage Your Business's Finances: SMB Financial Management

koronapos.com

koronapos.com business finances manage financial management small businesses ways set smb determine goals retirement separate benefits pay yourself early keep

Tips For Managing Your Personal Finances

reliablebookkeepingservices.com.au

reliablebookkeepingservices.com.au finances

9 Tips For Managing Small Business Finances - Razorpay Capital

razorpay.com

razorpay.com How Can You Stay On Top Of Your Business's Finances? | CFO Source

www.cfosource.net

www.cfosource.net finances tips

Manage finances. Managing personal finances right. How can you stay on top of your business's finances?