Investing in Peer-to-Peer (P2P) loans can be a wise decision for anyone looking to diversify their investment portfolio and earn attractive yields. P2P lending has gained significant popularity in recent years, and there are several reasons why now is a good time to consider investing in this alternative asset class.

1. High Yields

One of the key attractions of P2P lending is its potential for generating high yields. With traditional fixed-income investments offering minimal returns, P2P loans have emerged as an attractive option for investors seeking better returns on their capital. According to the data, P2P loans are currently providing yields of around 7%, significantly higher than other conventional investment avenues.

Image source: Pinterest

2. Diversification

Investing in P2P loans allows individuals to diversify their investment portfolio. By spreading their investment over a range of loans, investors can reduce their exposure to any single borrower. This diversification can help mitigate risks, as loan defaults may impact a smaller portion of the invested capital.

3. Transparency

P2P lending platforms provide transparent information about the loans available for investment. Investors can assess the risk profile of borrowers based on various factors such as credit scores, employment history, and loan purpose. This transparency allows investors to make informed decisions and choose loans that align with their risk appetite.

4. Access to Creditworthy Borrowers

P2P lending platforms have strict screening processes in place to assess borrower creditworthiness. By leveraging technology and data analytics, these platforms can identify and onboard borrowers with good credit profiles. This access to creditworthy borrowers increases the likelihood of timely repayments, reducing the risk of defaults.

5. Flexibility

Investing in P2P loans offers flexibility in terms of investment amount and duration. Investors can choose the desired loan amount and set the investment period as per their preference. This flexibility allows investors to tailor their investments to meet their specific financial goals and liquidity requirements.

Image source: i2i Funding

In conclusion, P2P lending presents an enticing investment opportunity with its potential for high yields, diversification benefits, transparency, access to creditworthy borrowers, and flexibility. As an investor, it's crucial to thoroughly assess the risks involved and choose a reliable P2P lending platform that adheres to strict underwriting standards. With careful consideration and a diversified approach, P2P loans can be a valuable addition to any investment portfolio.

If you are looking for My P2P Lending Investment Status - Investing Youngster you've came to the right place. We have 15 Pics about My P2P Lending Investment Status - Investing Youngster like How Does P2P Lending Fit in FIRE? - Mama Bear Finance in 2020 | P2p, Is P2P Lending In India Safe? | LenDenClub and also Be Consistent With P2P Investing: Here’s Why - LenDenClub. Read more:

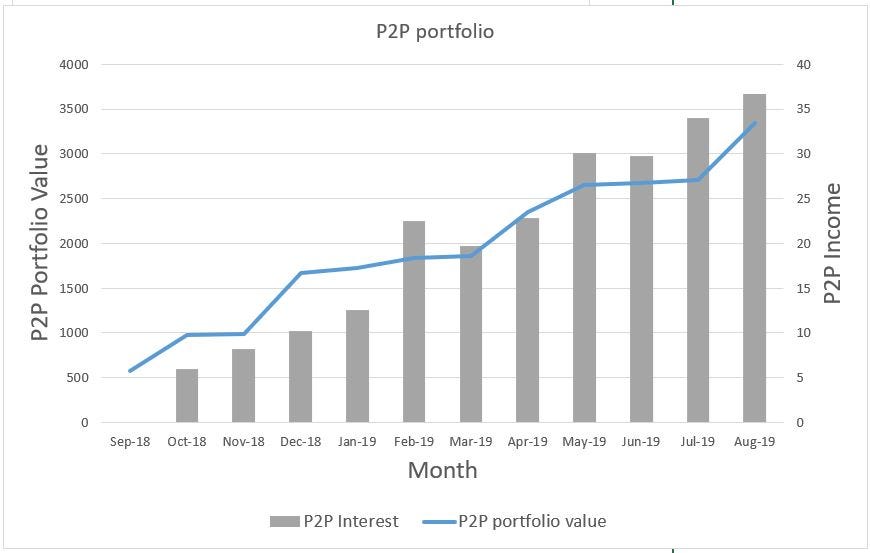

My P2P Lending Investment Status - Investing Youngster

www.investingyoungster.com

www.investingyoungster.com lending investment p2p status post

P2P Lending: Pros, Cons, And How It Compares To Other Investments

www.bondora.com

www.bondora.com Are Peer To Peer Loans Using Bitcoin Safe? - Bitcoin A Asset For P2p

ruangpintar390.blogspot.com

ruangpintar390.blogspot.com lending etimg p2p bitcoin peer borrow lend

Is P2P Lending Safe? Benefits And Risks, Explained

marketrealist.com

marketrealist.com Financially Free With P2P Lending | By ThePoorInvestor | Medium

medium.com

medium.com A Quick Guide: Why You Should Invest To P2P Lending

vidalia.com.ph

vidalia.com.ph lending p2p investment quick guide vidalia invest should why

How Does P2P Lending Fit In FIRE? - Mama Bear Finance In 2020 | P2p

www.pinterest.com

www.pinterest.com lending mamabearfinance p2p peer

Why Now Is A Good Time To Invest In P2P Loans (Hint: 7% Yields With

www.pinterest.com

www.pinterest.com Is P2P Lending In India Safe? | LenDenClub

www.lendenclub.com

www.lendenclub.com Be Consistent With P2P Investing: Here’s Why - LenDenClub

www.lendenclub.com

www.lendenclub.com lending p2p consistent choice

5 Reasons P2P Lending Must Be A Part Of Your Investment Portfolio

www.i2ifunding.com

www.i2ifunding.com P2P Vs. Mutual Funds - Choose The Better Investment Option - LenDenClub

www.lendenclub.com

www.lendenclub.com The Benefits Of P2P Lending | Monexo

monexo.co

monexo.co Is It Safe To Make Investments In P2P Lending During A Crisis Like

www.lendenclub.com

www.lendenclub.com p2p lending investments

The ‘Investment Product’ That Earns 12% & More When FD Offers Below 7%

lending p2p peer rbi earns

Is it safe to make investments in p2p lending during a crisis like. Is p2p lending in india safe?. Lending p2p consistent choice