In today's fast-paced world, it is essential for everyone to consider various investment strategies to secure their financial future. One such investment avenue that has gained significant popularity in recent years is mutual funds. Mutual funds offer individuals the opportunity to pool their money with other investors and invest in a diversified portfolio of securities.

Understanding Mutual Funds

Mutual funds are professionally managed investment vehicles that pool money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by expert fund managers who make investment decisions on behalf of the investors. Mutual funds offer investors a convenient way to access a diversified portfolio, even with limited funds, as the minimum investment requirements are relatively low.

One of the key advantages of mutual fund investments is the diversification they offer. By investing in the funds, investors are able to spread their investment across multiple stocks, sectors, or asset classes. This diversification helps mitigate risks associated with investing in individual stocks or bonds. Moreover, mutual funds are managed by professional fund managers who have extensive knowledge and expertise in the financial markets, providing investors with the reassurance that their investments are in capable hands.

Benefits of Mutual Fund Investments

There are numerous benefits of investing in mutual funds:

- Professional Management: As mentioned earlier, mutual funds are managed by skilled professionals who have a deep understanding of market dynamics. These fund managers analyze market trends, conduct thorough research, and make informed investment decisions to maximize returns for investors.

- Liquidity: Mutual funds provide easy liquidity, allowing investors to redeem their investments whenever they require funds. This makes mutual funds an attractive option for individuals who may need quick access to their money.

- Diversification: By investing in mutual funds, investors gain exposure to a diverse range of securities. This diversification helps reduce the overall risk associated with investing in individual stocks or bonds.

- Flexibility: Mutual funds offer flexibility in terms of investment amounts. Investors can start with smaller initial investments and gradually increase their investments over time.

When investing in mutual funds, it is crucial to consider your investment objectives, risk tolerance, and investment horizon. Mutual funds come in different categories, such as equity funds, debt funds, balanced funds, and sector-specific funds. Each category has its own risk-return profile, and investors should choose funds that align with their investment goals.

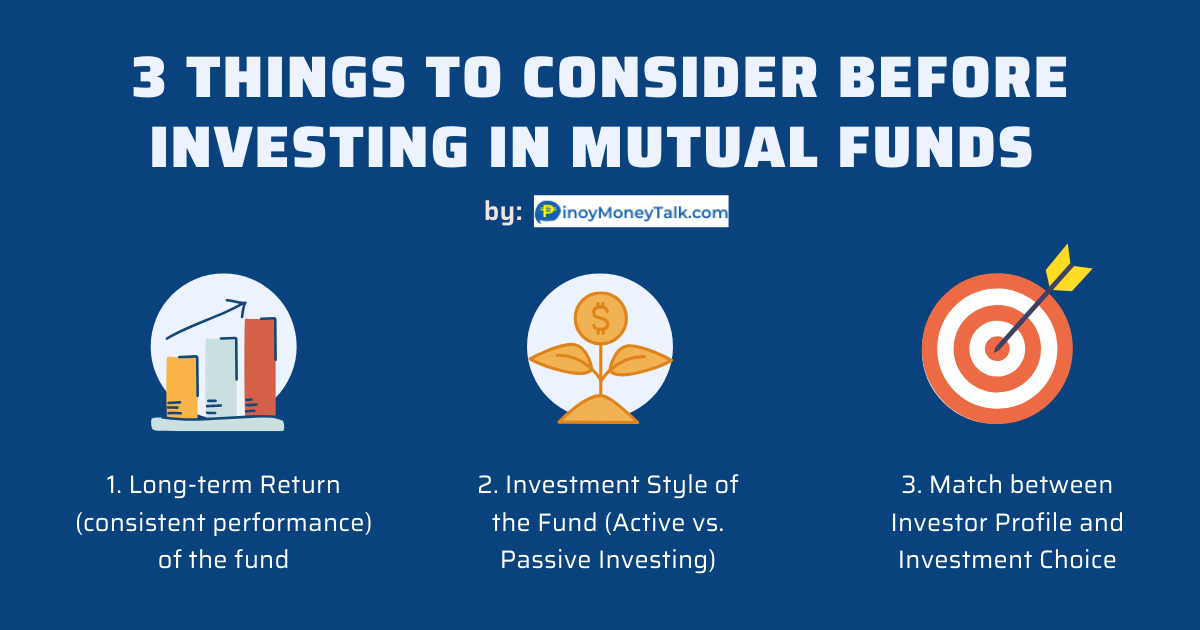

Furthermore, it is advisable to research and choose mutual funds with a proven track record of consistent performance. Evaluating factors such as historical returns, expense ratios, and fund manager credentials can help investors make informed investment decisions.

In conclusion, mutual funds offer individuals the opportunity to invest in a diversified portfolio of securities managed by expert professionals. The benefits of mutual fund investments include professional management, liquidity, diversification, and flexibility. Investors should carefully consider their investment objectives and risk tolerance before investing in mutual funds. By making informed decisions and monitoring their investments regularly, investors can maximize their chances of achieving their financial goals through mutual funds.

If you are looking for What is Mutual Fund? - Yadnya Investment Academy you've visit to the right place. We have 15 Images about What is Mutual Fund? - Yadnya Investment Academy like how to invest in a mutual fund in 5 simple steps - TheBooMoney, Basic Understanding of Mutual Fund! and also Mutual Fund Investment Tips: म्यूचुअल फंड इन्वेस्टमेंट के लिए करें. Here it is:

What Is Mutual Fund? - Yadnya Investment Academy

blog.investyadnya.in

blog.investyadnya.in mutual fund

Basic Understanding Of Mutual Fund!

2640kf.imgcorp.com

2640kf.imgcorp.com Mutual Fund Investment Exemplified

www.mutualfundpatna.com

www.mutualfundpatna.com mutual funds fund investment advantages investing equity benefits start business exemplified market elss investors now money finance essentials

Mutual Fund Investment Tips - Startupz Culture

startupzculture.blogspot.com

startupzculture.blogspot.com mutual investment fund tips

My Experience Investing In Mutual Funds In The Philippines » Pinoy

www.pceaglescry.org

www.pceaglescry.org How To Invest In A Mutual Fund In 5 Simple Steps - TheBooMoney

theboomoney.com

theboomoney.com What Is A Mutual Fund: Discover 3 Sources To Make Money From Mutual

www.pinterest.co.uk

www.pinterest.co.uk mutual funds plainfinances

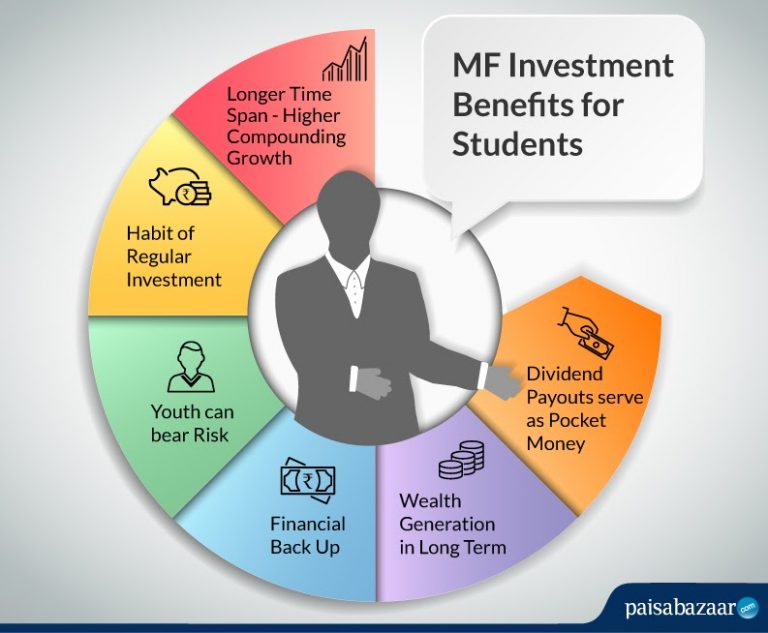

Best Mutual Fund Scheme For Students - Compare & Apply Loans & Credit

www.paisabazaar.com

www.paisabazaar.com mutual fund funds invest

Best 3 Mutual Fund Investment Apps For Android Mobile | TechRounder

www.techrounder.com

www.techrounder.com fund mutual funds techrounder levels

Mutual Fund Investment Tips: म्यूचुअल फंड इन्वेस्टमेंट के लिए करें

moneytime.co.in

moneytime.co.in What Is A Mutual Fund Investment?

www.stockgeni.com

www.stockgeni.com mutual funds

Seven Reasons To Do A Sip Mutual Fund Investing Infographic | Mutual

www.pinterest.com

www.pinterest.com sip mutual investment funds

Mutual Fund Investment - YouTube

www.youtube.com

www.youtube.com mutual

Simple Tips For Beginners In Mutual Fund Investing | Mutual Funds

www.pinterest.com

www.pinterest.com Mutual Funds - Overview, Types, Objectives, Importance - Koshex Blog

blog.koshex.com

blog.koshex.com mutual fund objectives

Mutual investment fund tips. Basic understanding of mutual fund!. Fund mutual funds techrounder levels